New data from DealerSocket’s Inventory+ team reveals that dealers are betting on a high degree of pent-up demand when markets open up.

By Gregory Arroyo

Field reports from DealerSocket’s team of Strategic Growth Managers reveal that dealers haven’t pushed the panic button just yet. Their focus is on the high degree of pent-up demand they believe rests on the other side of the industry’s recovery from the COVID-19 pandemic, and the chance to pick up market share when markets begin to open up.

A Strategic Growth Manager operating in the Sacramento, Calif., area noted that dealers benefited from the way things came to a halt quickly vs. a slow drip. That allowed them to make inventory and staffing decisions through March, as well as seek expense relief from their floorplan finance sources and technology vendors.

For dealers with closed showrooms or stores operating with limited staff due to strict social distancing guidelines, there was little time to delve into emerging sales trends they had not experimented with before the pandemic. In a lot of cases, management teams handled appointments and sales in the absence of sales staff.

DealerSocket’s Strategic Growth Managers report many learnings and process refinements at dealerships, especially for operations that had tested remote sales and digital retailing.

By the Numbers (National):

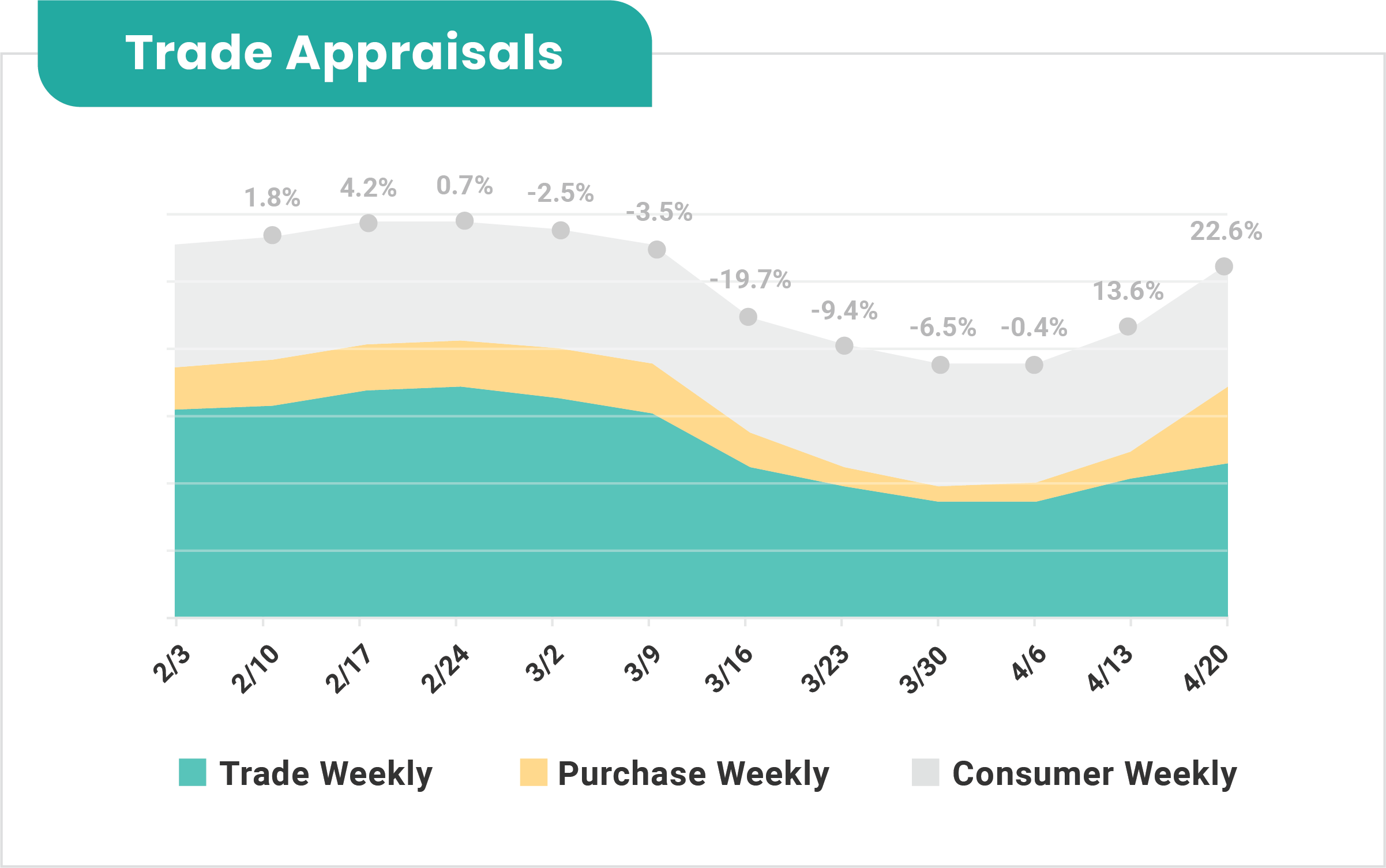

- Total appraisals fall 34.4% from the first week of March to the first week of April.

- Total appraisals register steepest week-over-week dip the week of March 16 (-20%), with Trade (involving consumer trade-ins) and Purchase (involving auction/wholesale vehicles) appraisals falling 26% and 35%, respectively.

- Appraisals initiated by consumers through online forms hold steady through the period after inching down 2% the week of March 16.

- Purchase appraisals record a 182% week-over-week spike the week of April 20, three days after auto sales deemed essential by the U.S. Department of Homeland Security.

- Trade appraisals show a 34.3% increase over a three-week span ending the week of April 20.

Appraisals Fall

In terms of pre-owned inventory, Strategic Growth Managers operating in the Northeast report that some dealer groups were able to squeeze in trade desks just before stay-at-home orders took effect. Multi-state dealers on the East Coast were also able to reshuffle inventory out of areas with strict sales guidelines.

Beyond that, there’s wasn’t much to do with respect to managing inventory, aside from updating vehicle listing and other merchandising activities.

Virtual auctions reported strong attendance in March. The problem was, dealers weren’t buying, with KAR Auction Services reporting an 84% decline in volume for virtual sales nationwide. And with the physical auctions closed and big dealer groups not buying, the firm reported a 12% decline in wholesale values — 15% if adjusted for fewer lower-priced trade-ins.

“We have heard repeatedly from dealers … about their hesitancy to put a value on a trade-in that is not part of their core inventory,” Black Book stated in a recent report, adding that dealers are hesitant to get stuck with vehicles they don’t traditionally stock in a depreciating market.

Data from DealerSocket’s Inventory+ team shows a 20% week-over-week decline in total appraisals the week of March 16, when most stay-at-home orders took effect. Trade appraisals, or appraisals that occur on a customer’s trade-in, were down 26% during the same period, while “Purchase Appraisals” on wholesale and auction units plunged by 35%, according to the data.

Overall, appraisals were down 34.4% from the first week of March to the first week of April. However, activity has trended up since.

Markets In Recovery

As of the week of April 19, according to J.D. Power, nearly all markets are in recovery or exhibiting growth, as dealers adapt and selling regulations are clarified.

DealerSocket data also reveals a pick-up in activity, with appraisals spiking the Monday following April 17. That’s when the U.S. Department of Homeland Security deemed auto sales an essential service. Much of that lift, however, was from dealers appraising wholesale and auction vehicles, which increased 182% from the week prior.

DealerSocket’s data also revealed an uptick in consumer activity, with appraisals on consumer trade-ins increasing 34.3% during the first three weeks of April. Even more compelling is appraisals initiated by consumers through online lead forms remained steady throughout the period after inching down 2% on a week-over-week basis the week of March 16.

A snapshot of website traffic by DealerSocket’s DealerFire team also reveals a normalization of online consumer behavior, with organic traffic climbing 15% to 20% over the 10-day period ending on April 24. Dealerships located in states that allowed showrooms to remain open saw a sharper overall rebound. In contrast, dealers in states with a high number of COVID-19 cases continued to experience significant declines in site traffic.

However, those dealers are now starting to see increases, with consumers returning to more normal browsing behavior. “In both cases, traffic has rebounded in the past week,” read DealerFire’s April 24 Digital Marketing blog. “But in Texas, the traffic has already come back to very near pre-COVID numbers.”

Leads have also been trending upward, with DealerFire data revealing that dealers in areas less affected by COVID-19 are now seeing numbers equal or within striking distance of pre-COVID-19 trends. Even dealers in heavily impacted areas are seeing an uptick in lead submissions.

Late Models a Concern

On the retail side, dealers continue to hold the line in terms of their asking price for the Top 50 makes and models, which inched down 3% from the week of Feb. 16-29 to the week of April 14-20, according to DealerSocket data. However, there is evidence dealers are willing to meet customer demands, with the data revealing some front-end gross erosion. Still, dealers have lowered their selling price just 1% during the period. Days’ supply, however, was up 718%.

The immediate concern is aging, especially if the expected feeding frenzy never materializes. If it does, throw aging out the window, said on Strategic Growth Manager in the Northeast, as dealers will be able to demand higher gross profits. There are exceptions, however.

Current model-year and one-year-old pre-owned vehicles could be problematic, as automakers continue throwing big rebates, deferred payment programs, and other incentives on the hoods of new models. So far, according to J.D. Power, incentives remained at a record level of $4,700 per unit during the week of April 19, which could be enough to pull pre-owned buyers to new-vehicle lots.

Lease extensions permitted in March could also hamper the values of late-model units, with many of those off-lease vehicles expected to hit the market by the end of April.

As for profit drivers, the belief is the potential lies in three-, four-, and five-year-old vehicles, especially with the deadline for filing federal income taxes extended to July 15 and the IRS drowning in unopened tax refund requests.

That’s why dealers are holding onto inventory, as they know availability will be critical. The big question is just how quickly things will come back, especially given that the used-car guides typically take 14 to 30 days to adjust.

Positive Signs

The good news is many of the challenges dealers experienced during the Great Recession have yet to materialize. For instance, the national average for a gallon of gas, according to the latest data from AAA, has dropped 48 cents in the last month to $1.883 — the cheapest in more than four years. During the height of the Great Recession, the national average peaked at $4.10 a gallon.

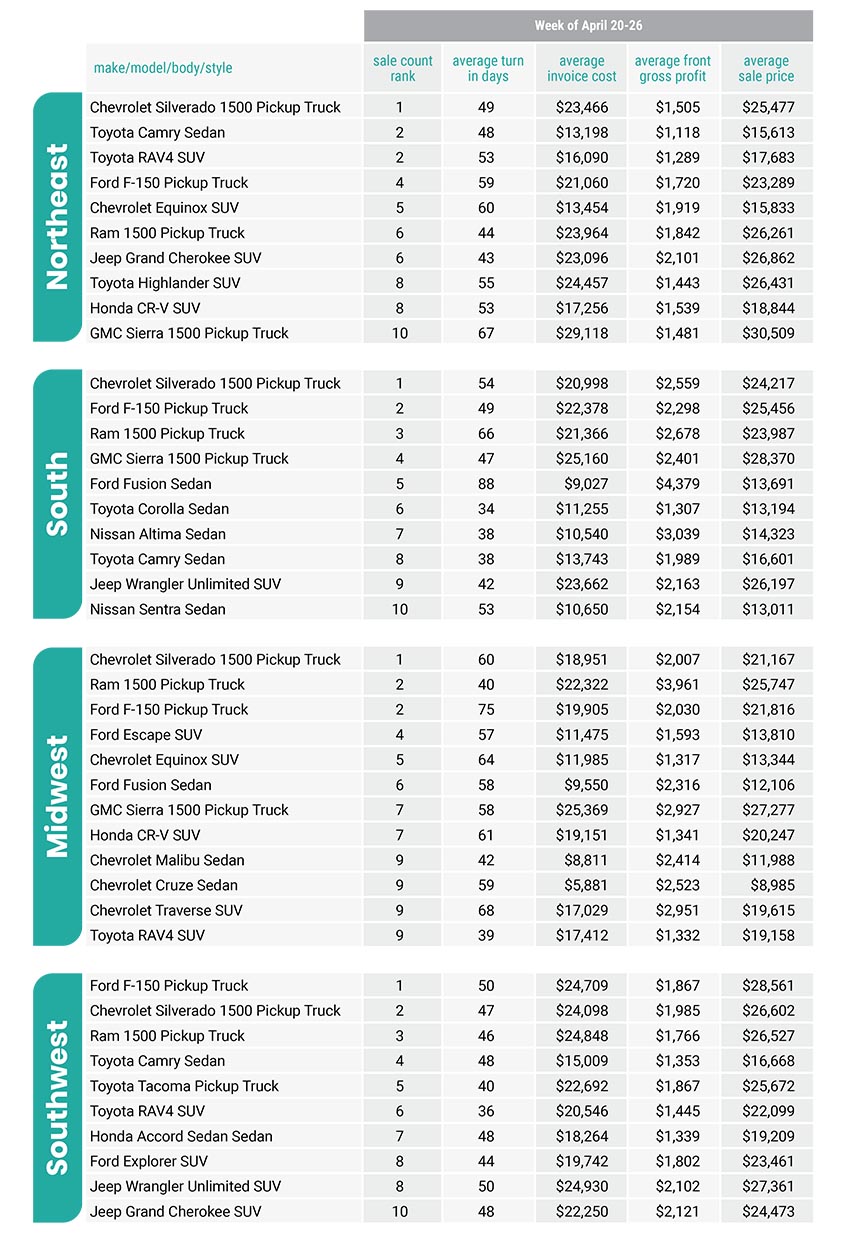

That might explain why trucks and SUVs dominate DealerSocket’s Top 10 pre-owned sales lists for all regions except the South (See Charts). In fact, J.D. Power called the pickup segment the most resilient in the industry in a recent report. Recovery in the SUV segments is also gaining steam.

Also absent is the credit tightening seen during the last recession, with J.D. Power noting that finance sources have greeted record transaction prices — the average reaching a new high of $35,800 during the week of April 15 — by approving higher loan-to-value ratios across the full spectrum.

“Consumers in all credit categories are purchasing and financing more expensive vehicles,” the firm stated in its report, adding that a higher percentage of buyers are also financing “more than the value of their vehicles relative to historical levels.”

There are looming signs on the horizon, however. As reported by Automotive News, Ally Financial Inc. told investors during a recent call that 15% of its auto-loan customers have asked for payment deferrals. And of the 1.1 million borrowers who requested forbearance, 70% had never had a late payment.

Automotive News also reported on April 21 that Credit Acceptance Corp., which specializes in financing credit-challenged buyers, warned of a sharp drop in payments. The firm was among the first to report an uptick in delinquencies, the publication noted.

Conclusion

In terms of most-likely and worst-case scenarios, Black Book projects a 25% drop in new-vehicle sales if unemployment jumps to 10%, as well as a 17% drop in wholesale values compared to pre-COVID projections, with some recovery in the fall. The firm’s worst-case scenario has new-vehicle sales and wholesale values falling by 40% and 25%, respectively.

Consumer confidence and unemployment filings will be critical indicators in the weeks and months ahead, with KAR Chief Economist Tom Kontos noting that values should improve once new filings dip from the millions to pre-pandemic averages of about 250,000 claims per week. While he doesn’t expect wholesale values to fall 20% below seasonal averages, he warns it could be close.

J.D. Power put 2020 retail sales at between 11.3 and 12.5 million and total sales at between 12.7 and 14.5 million vs. its baseline of 16.8 million. The firm also projects that the virus could eliminate between one million and 1.7 million sales between March and July.

As for dealers, the big unknown is pricing, which means transactional data will be a critical guide as they navigate the recovery. Their physical inventory should be their No. 1 priority, as well as their virtual showrooms. Vehicles need to be cleaned, and merchandising activities need to be kicked into high gear. That means updating photos and vehicle descriptions, as well as refining their digital marketing and data mining strategies to get eyes on their inventory.